Swaps are contracts that allow people to manage their risk in which two parties agree to exchange cash flows between a fixed and a floating rate holding. Generally speaking, the party that receives the fixed rate flows on the swap increases their risk that rates will rise.

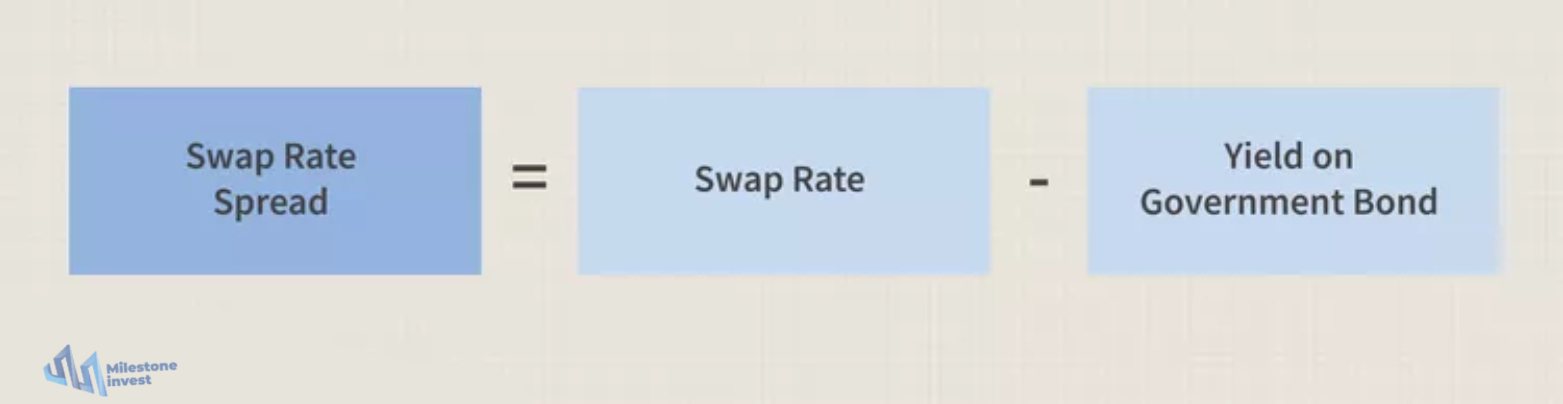

At the same time, if rates fall, there is the risk that the original owner of the fixed rate flows will renege on a promise to pay that fixed rate. To compensate for these risks, the receiver of the fixed rate requires a fee on top of the fixed rate flows. This is the swap spread.

A swap rate is a rollover interest (that's earned or paid) for holding positions overnight. We simply make an interest adjustment to your account, which is either a debit or a credit, to reflect the cost of funding your position. The Swap rate is the interest rate charged to lenders who allow the borrower to receive a fixed-rate loan. Start Trading Righ

Stock trading has been around for centuries and is still the most common way for traders, banks and funds to buy and sell a company’s shares. The first actual stock exchange started trading in London in 1773 and today the market capitalisation of traded stocks worldwide is estimated at more than $70 trillion.

The traditional way of buying and selling company shares is for investors to purchase a stock and wait for an increase in the value, in order to make a profit. This relative long-term strategy means you hold the stock for a period of time so as to have partial ownership in that company. This relative long-term strategy means you hold the stock for a period of time so as to have partial ownership in that company.

Share trading is the most common type of derivative trading. It involves buying and selling shares in a company and is open to investors who want to buy, sell or hold shares and companies who wish to raise capital by issuing shares. Trading derivatives can be lucrative, and it's easy to get started. Our trading tools allow you to trade shares in a regulated market, using our platform.

Support

Countries

Transactions

per hour

Largest

Transactions

Years

of Experience